- The usage of our home since an initial residence, in the place of an investment property

Of numerous downpayment guidelines apps is across the country. Thus if you find yourself a current Arizona resident trying to escape out-of state, many selections arrive. There are even numerous info for from inside the-county just use. In the a granular level, particular apps appear in certain towns or counties.

USDA mortgage brokers

The USDA processes involves the traditional measures regarding implementing, underwriting, and you will purchasing closing costs. These fund are very useful in being qualified rural section as well as young, first-go out homebuyers.

USDA funds promote no cash off at time of closing, competitive interest levels, reduced home loan insurance coverage (paid monthly), and you may lenient and versatile borrowing from the bank official certification. Homebuyers must be Us owners who can inform you consistent income and you will the ideal financial obligation to help you earnings proportion.

Va mortgage brokers

So you’re able to qualify for a good Virtual assistant financial, consumers have to use through the Agencies out-of Experts Things. Basically, this type of funds was reserved to have active obligations service players, pros, partners, and you may qualifying beneficiaries. Within the Virtual assistant process, first-big date homeowners meet the requirements getting ideal loan conditions than simply people to shop for a consequent house.

Household when you look at the Four lenders

The house inside the Five Advantage Program is made specifically for reduced-income some one in the Maricopa State, Washington. It downpayment advice alternative also provides 5%, that wade into a down payment and you may settlement costs. There are certain issues that the customer need certainly to fulfill, and you can picked belongings likewise have some requirements to meet.

Qualifying public service organization, instance K-a dozen teachers and you may disaster responders, can be entitled to more dollars advantages of House instant same day payday loans online Iowa inside Four.

Domestic And lenders

The new Arizona Home Together with home loan program is made for Washington residents whoever domestic money is below $105,291 per year. The application was continuously increasing inside the popularity which can be supposed to assist basic-date homebuyers make so much more house requests from the state. The program advertises as much as $19,2 hundred from inside the down payment guidelines and will be offering versatile mortgage choices for people of all the economic experiences.

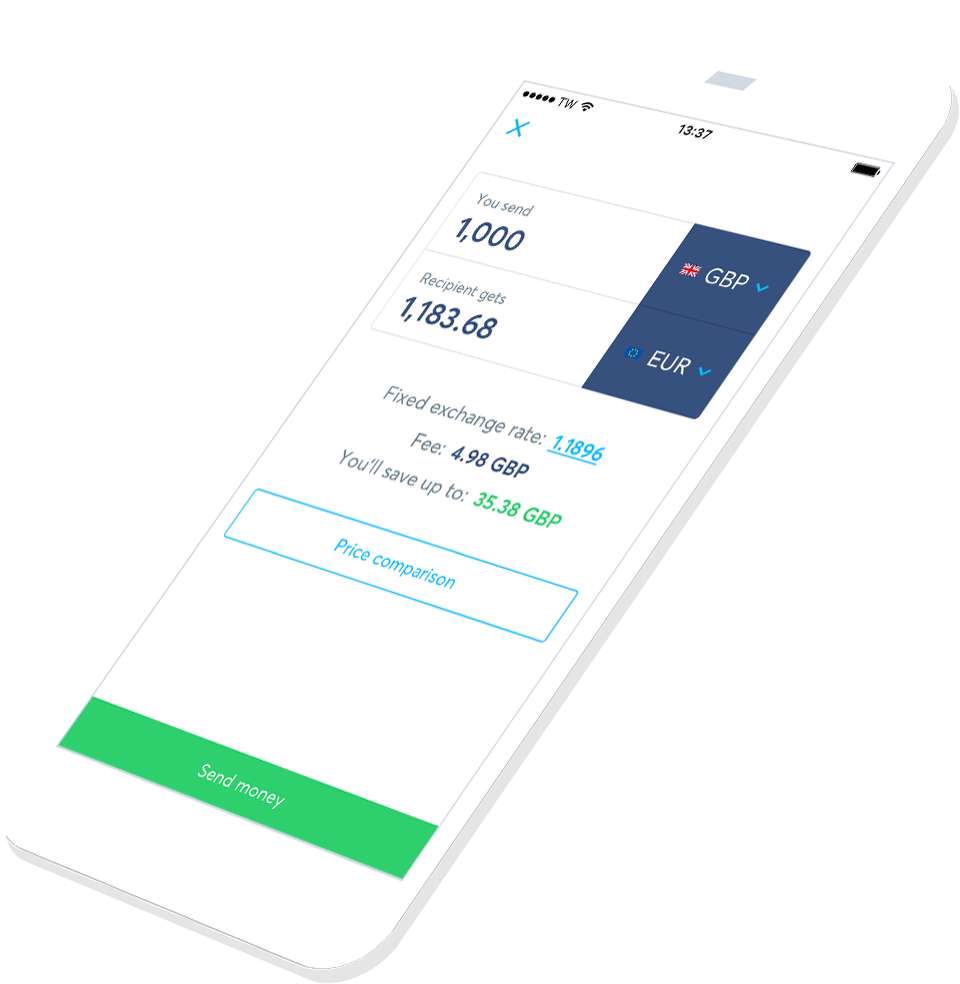

To own Washington owners, the total amount due when you look at the a downpayment is proportional on number of the home financing. It dollar number and varies in line with the sort of mortgage you qualify for or which you see. Having an accurate photo, you will have to enter this short article to the a home loan calculator:

- The price of the home you need to pick

- This new portion of the downpayment you plan so you can lead

- The phrase (or length) of your own mortgage in years

- The pace you be eligible for using your selected lender

Consequently, the mortgage calculator often reason for multiple elements that define your general payment. These number will establish:

- How much cash you are able to pay when you look at the dominant and you will appeal per month

- How much possible pay inside the property taxes and homeowners insurance

- The latest estimated cost of personal mortgage insurance rates (PMI)

Financial hand calculators cannot give a vow out-of exactly what your particular percentage state would be, nonetheless they would promote a helpful first faltering step because you lookup to own house and place your financial allowance.

Tips to have Arizona Homebuyers

According to You Census Bureau, of 2014-2018, the owner-filled houses rate inside the Washington try 63.6%. In that exact same time, Washington home values noticed a growth. As a whole, home values and you can average money membership operate in combination in order to train the amount of cost to possess Washington family.

If you are searching to purchase a home during the Washington and need more info on the recommendations, next information are great towns to start.

No responses yet