Will you be probably buy a house? If yes, then it is crucial to has a very clear and you will in depth understanding of the house loan process, that’s essentially split into step three values, we.e., software, loan approve, and you will disbursal. Around many of these amounts, loan sanction is a vital you to because this is the fresh stage where the loan is often approved otherwise refuted. Following home loan software processes initiate, the financial institution verifies the newest records of your own applicant and you will makes a beneficial choice to help you accept or refuse the borrowed funds. The borrowed funds is approved when the and only if your specified requirements was satisfied flawlessly. Because loan is eligible, the lender usually material an effective Approve Letter, that’s proof your eligible for the house financing.

Thus, if not see far regarding the sanction page and its particular role in getting a mortgage, next this article is actually for your! See through to the prevent having a much better knowledge of the topic.

What is actually bad credit personal loans Georgia a Sanction Page?

An excellent Approve Letter the most important files for the the home loan processes. Whether or not you’re taking a loan to have strengthening a beneficial huge household or a little household, Approve Letter performs a significant role all the time. Good Sanction Letter is actually a file available with new financing monetary facilities or lender for the debtor. So it document says the home loan has been approved. On top of that, it has the conditions and terms on the basis of and this the mortgage could be offered to the candidate.

Due to the fact candidate receives the mortgage Approve Letter, the bank or lender organization delivers an official offer page bringing up the crucial facts associated with the home financing. New applicant will then be required to indication the fresh new desired copy and you may fill out it back into the financial institution otherwise standard bank. At this time, you need to have a look at the information offered regarding Sanction Letter carefully and you can see the small print.

Today, the home loan application process might have been simplistic, with several creditors and you can finance companies offering digital modes to put on having an age-mortgage. It furthermore continue the ability to get an electronic Home loan Sanction Letter. As term suggests, a digital Home loan Sanction Letter is a digital sorts of the house financing recognition file that the financial situations just before giving the past home loan contract on applicant.

Files You’ll need for your house financing Approve Page

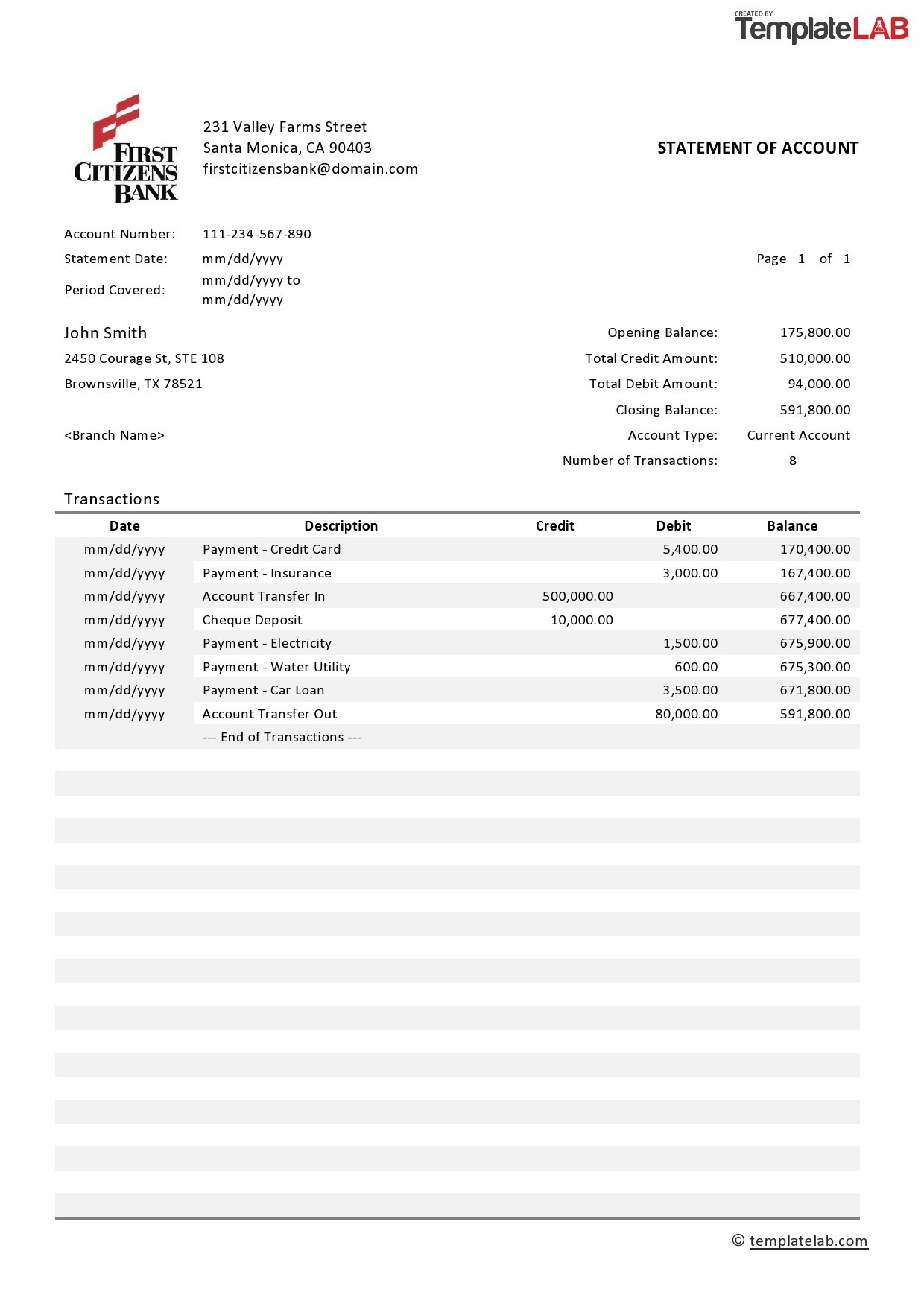

A financial or standard bank tend to charge a fee certain data as submitted in advance of providing a great approve page. The latest documents get cover:

Exactly how is Sanction Letter distinctive from From inside the-Idea Recognition and you will Disbursement Letter?

Most people have a tendency to confuse good Sanction Page with in-Principle Recognition and you may Disbursement Letter, but they are various different indeed. In this section, we are going to clear out the differences between them.

In-Idea Approval refers to the procedure which the lending company assesses new monetary status of your candidate and provide an out in-Principle Recognition letter. That it page pledges that lender will offer the loan, subject to the fresh new effective confirmation of data. Generally, loan providers give you the Inside-Concept Approval characters to have pre-acknowledged finance. Better yet, nonetheless they ask you for which is later on modified within the the total mortgage running charges. The fresh authenticity of the letter range out of 3 to 6 weeks, with regards to the financial.

Conversely, an effective Sanction Page to own a mortgage was an official document stating that you’ve got end up being permitted acquire the amount borrowed. New terms and conditions manufactured in the fresh letter are still appropriate till the new date specified about letter. It is very important note that the financial institution could offer the original conditions applied or can modify them for the base of your own financing eligibility of candidate.

No responses yet