Amortization Plan

- Graph

- Schedule

In this article

- With the commercial home loan calculator

- Words understand whenever obtaining a commercial home mortgage

Play with the 100 % free industrial home mortgage calculator so you can estimate the fresh new specifics of a commercial financial easily and quickly. According to research by the studies your input, the commercial loan calculator will help you assess your estimated monthly Prominent and you may Desire (P&I) fee into the mortgage and you will a destination Just commission and you may Balloon commission.

Regardless if you are looking at Fannie mae Multifamily loan, Freddie Mac computer Multifamily loan, CMBS mortgage, or FHA/HUD commercial multifamily fund, there are many information you should promote. You will need to understand the:

- Principal Amount borrowed ($)

- Interest rate (%)

- Readiness (years)

- Amortization (years)

The size of very Commercial a residential property mortgage loans differs from five age (otherwise smaller) in order to 20 years, plus the amortization several months is often longer than the definition of regarding the mortgage.

Commonly skipped ‘s the amortization plan when figuring payments. In some cases the fresh new amortization can have a larger impact on the fresh payment per month as compared to actual rate of interest of your own commercial mortgage.

Exactly what the A property Home loan Calculator Shows

Brand new amortization plan suggests exactly how the month-to-month mortgage payment try broke up anywhere between focus and you can dominant across the time of the borrowed funds. Much of your percentage goes into desire up front of one’s mortgage, but it will move to help you mainly going into the the balance since your mortgage nears the avoid.

When comparing whether you really can afford a certain financial, it is vital to remember that your own mortgage repayment is actually singular of will set you back that come with to order a commercial possessions. You will also need to pay insurance costs and fees, that will cost you apparently rating separated into month-to-month escrow payments even when they have been owed only one time a year.

Most other costs to consider were landscape charge, utility will set you back (including hvac costs) and you can repair will set you back. Your own mortgage payment and all these most other expenses should complement easily in the businesses monthly funds.

Conditions to learn When Obtaining a professional Real estate loan

Since you imagine various other a property home loan alternatives and rehearse new home loan calculator, you will find some tech terms and conditions to be familiar with and in addition we a beneficial

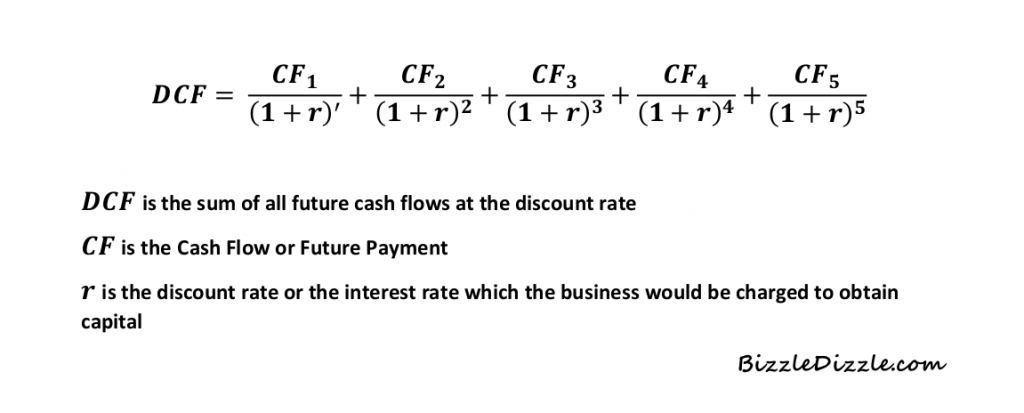

Amortization Several months: A method to debt payment, in which repaired money are built on the a good lined up agenda. The fresh new money try divided anywhere between prominent and attention. Really amortization schedules drop off simply how much regarding a fees visits desire and increase simply how much visits dominant because financing proceeds.

Balloon Percentage: A one-go out commission that’s produced at the a certain point in a loan’s cost agenda. Balloon payments be much more well-known toward commercial a house mortgages than simply residential home loans, even in the event loads of mortgage loans which have balloons are available.

Personal debt Provider Coverage Proportion: Known as DSCR, your debt services visibility ratio methods good borrower’s power to repay on the financing. So you can calculate DSCR, divide the web operating earnings by the overall loans service. One value significantly more than one to shows that your debt is actually much for anyone otherwise organization.

Collateral: The fresh new investment that is regularly safe a loan. If the debtor neglect to repay to your financing, the lending company could possibly get seize any collateral that is offered resistant to the loan. That have home mortgage loans, the new equity made use of is the possessions which is ordered.

Mortgage so you’re able to Well worth Proportion: Known as LTV, the loan in order to really worth ratio to choose exposure visibility also to assess a beneficial borrower’s influence. The new ratio is actually computed by the separating the borrowed funds number (principal) because of the total property value new asset (collateral).

Financial obligation Give A proportion that shows the amount of money generated by a possessions than the how much is actually borrowed thru a loan. The newest give is actually calculated by separating web functioning income from the loan count (principal), plus it suggests exactly what the bucks-on-cash output would-be to possess a loan provider in the event of property foreclosure.

Readiness Date: Often called the latest expected life from that loan, the fresh maturity big date ‘s the time on what www.paydayloanalabama.com/clayhatchee/ an effective loan’s last prominent percentage is generated. Attention is not energized following this percentage is made, while the financing is considered to be paid-in complete during the this time.

Finest Price: The quality rate made use of when you compare rates given by other loan providers. The pace was what is approved to help you a good lender’s most reputable members. Of a lot website subscribers pay a higher rate depending on the creditworthiness, however, all the prices are based on which speed.

Prepayment Punishment: Prepayment punishment come in the type of step-down prepayment punishment, and this begin on a certain commission and you may drop because of the step 1% annually. To have conduit funds, and you may CMBS they are generally offered in the type of give repairs or defeasance. Yield maintenance needs a debtor and come up with a fees to good financial you to definitely compensates them for attention efficiency they will have achieved met with the debtor maybe not reduced the loan early. Defeasance occurs when a debtor purchases a basket away from ties into the order to restore the brand new guarantee of its loan.

Dominating and you can Appeal: Known as P&I, dominating and you can notice are two distinctive line of facts within this a real home loan. Principal is the new loan amount in the financial, and attract ‘s the number charged for credit the primary. To one another, dominant and you may attention make up what is actually reduced on most basic genuine property mortgages.

Refinance: Something by which a lender and obtain agree to improve otherwise rewrite the regards to a loan. The first loan try efficiently sensed paid in complete from the duration of refinancing, and it also becomes replaced with yet another loan.

Non-Recourse: A low-recourse industrial loan is just one in which a lender don’t take to going immediately after good borrower’s individual property once they default toward its loans. Although not, really non-recourse money have is stipulations that financing might be an effective complete recourse financial unit if the debtor break certain regulations, including purposefully declaring bankruptcy or providing misleading economic advice so you’re able to the lending company.

No responses yet