At the same time, we assume banks to carry on to help you rely shorter towards the main financial financing and more to the loans

We predict financial services issuance in the world to grow regarding 14% during the 2024, and you will seven.5% next year. Up changes towards the first 50 % of the year, along side good growth of on the 18% from the third one-fourth, have led to international monetary attributes issuance broadening from the 15% year up to now.

Issuance energy to own economic attributes places the fresh market on course getting a record overall this present year. While this , we see possibility growth. For example, i predict U.S. financial institutions to keep steady issuance the following year.

Banking institutions generally lead regarding the one-3rd out of yearly monetary qualities issuance regarding You.S. In the 2024, U. Suffered deposit outflows ultimately concluded regarding the next quarter off history year but resumed regarding second one-fourth with the year. And manner when you look at the deposit flows basically direct near-term issuance (come across chart 9). However, while you are simpler comparisons are before, we do not acceptance one apparent reduced amount of their issuance totals next year.

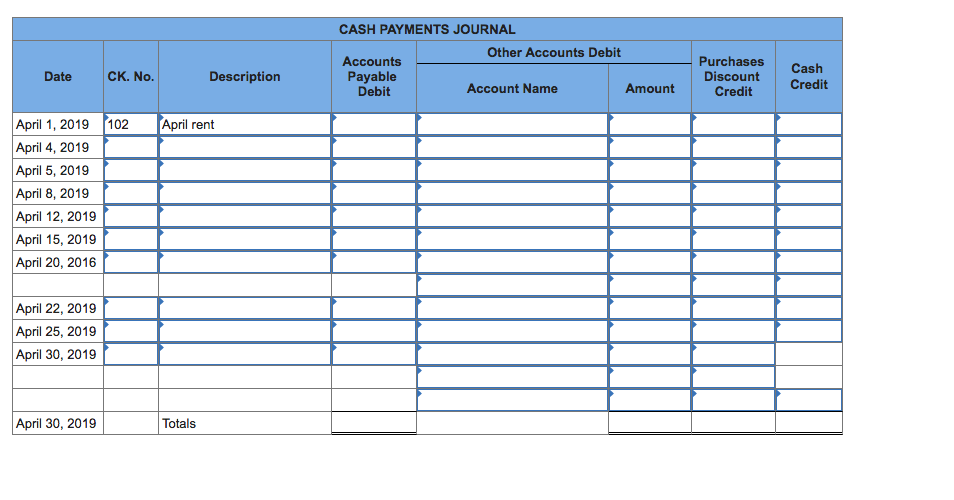

Graph 9

I enjoy proceeded strong issuance next season into the European countries, where banks lead around 60% out of yearly financial services issuance. I predict healthy issuance regarding financial institutions because they endeavor to see their losings-taking in ability buffers, particularly their qualified minimum significance of own financing and you may eligible obligations instruments.

Getting Asia, monetary properties issuance gains has actually slowed because the 2021, just after several years of exceedingly solid growth. We acceptance which moderation continues, considering the state’s overarching loans reduction services. Yet not, just as in almost every other groups, issuance you may shock with the upside in case your regulators and main lender increase aids amid flagging demand and you can financial growth.

Around the world structured fund issuance you may go up 20% or maybe more this season, up coming because of these lofty totals. Through the third one-fourth out of 2024, all over the world organized financing issuance tallied $step 1 trillion, up twenty six% season over season.

I 1st questioned the latest good start to the entire year so you’re able to reasonable just like the 2024 progressed. Once a robust second quarter alleviated risks, that moderation occurred in the 3rd one-fourth, whenever issuance dropped 20% from the prior one-fourth. I predict so it moderation to continue about 4th quarter.

We anticipate in the world planned funds issuance to keep strong however, fall 7% (having various -14% in order to apartment) in 2025, mainly based on diminished issuance regarding U.S., with perhaps come more powerful than the growth in the underlying guarantee would indicate. While you are subsequent speed slices and you may pass on toning is always to assistance issuance, we think it can slow prior to such as for example a robust 2024, and now we predict increases might possibly be combined round the regions and you may advantage kinds.

Even as we assume people to profit just like the main banking institutions continue to lower cost, the pace and magnitude away from next rates slices as well as how much time they test happen so you can private customers stays uncertain and will will vary because of the region. Because of this, consumer-against groups like house-supported ties (ABS) and residential mortgage-recognized securities (RMBS) will be in focus inside the 2025. Not https://paydayloanalabama.com/pea-ridge/ merely perform they show the new lion’s express regarding in the world organized financing issuance, however they are also most rates delicate. Higher-for-longer prices you will definitely moisten issuance on these sectors.

Particular challenges is emerging in the You.S. also, together with rising delinquency cost to have handmade cards and you may automotive loans, along with standard just for smaller develops home based sales next year. When you look at the Europe, criterion the real deal salary development should stabilize user expenses here, otherwise support grows, nevertheless You.S. express from issuance dominates the global overall.

Brand new European structured fund sector grew 12% through the third one-fourth, largely because of a great 65% increase in securitization issuance that due with the 88% uptick within the collateralized loan obligations (CLO) issuance and you can strong develops when you look at the Abs and you may RMBS.

No responses yet