While using an effective HECM, consumers can like how they discovered funds-either by way of a predetermined payment per month or a personal line of credit if you don’t some mix of all of those people choice. The cash are used for people mission.

Exclusive reverse mortgage loans

Exclusive reverse mortgages was supported by anyone lenders providing them instead of the regulators. And as opposed to HECMs, such finance are generally open to borrowers younger than just 62. Specific lenders provide contrary mortgages so you can candidates that happen to be since the younger once the 55, says Steve Irwin, chairman of your own Federal Contrary Mortgage lenders Connection (NRMLA).

At the same time, proprietary contrary mortgage loans are notable for offering high loan amounts than just HECMs. It means for individuals who individual property worth $one million or $2 million or maybe more, you are able to supply a lot of collateral due to an effective proprietary reverse home loan than simply when using a great HECM.

The latest FHA financing limit having a HECM are $970,800 already, with the intention that form just $970,800 away from family worthy of represents. For those who have a home over $one million one to extra value is not determined, teaches you Irwin. Certain exclusive mortgage loans go of up to $4 mil in order to $6 million, making it a lot more of a good jumbo product.

Single-objective opposite mortgages

Even the minimum prominent and in some cases, least expensive alternative, single-objective opposite mortgages are offered because of the condition and state agencies. Oftentimes, non-winnings supply such mortgage loans.

Single-mission opposite mortgage loans can only just be studied for a single recognized purpose specified because of the financial, claims Fraser. You to mission may include things such as property fees or family fixes.

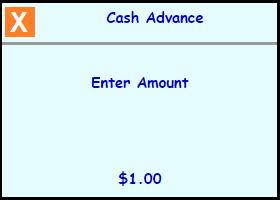

This type of contrary mortgage loans generally render the means to access a very minimal quantity of domestic collateral, meaning the brand new fund are https://cashadvancecompass.com/loans/web-cash-loans/ shorter, Fraser demonstrates to you. Occasionally, single mission reverse mortgage loans can certainly be restricted to residents with lower in order to average money.

Opposite financial standards

Just like the certification criteria to possess an other mortgage can differ a little within around three mortgage choice and lenders providing them, the newest standards essentially has:

Regarding the newest HECM, individuals should be at least 62 years old. For proprietary reverse mortgages, this minimums can vary in some cases consumers will get getting as early as 55 in order to 60, says Irwin.

Contrary financial candidates have to meet with a different homes counselor to go over their profit and the effects of a reverse financial. Whether it is proprietary opposite financial otherwise a keen FHA-insured HECM, independent, third-party guidance becomes necessary, claims Irwin.

Home loan balanceMost opposite mortgage loans wanted you to definitely candidates both own your house outright otherwise possess at the very least reduced a substantial percentage of the loan.

Very loan providers require you to definitely candidates not have any federal financial obligation, especially in possible off HECMs. For example things like federal income taxes and you can government student financing.

Updates of your own homeTypically, our home have to be who is fit so you’re able to qualify for an excellent opposite home loan. If not, the financial institution may require fixes before proceeding for the financing.

You can find advantages and disadvantages so you can opposite mortgages which should be considered meticulously in advance of proceeding. Such mortgage is almost certainly not right for anyone centered on the brief and you can much time-identity financial requirements.

Pros: Legitimate circulate of money

Whether you select lingering money otherwise a personal line of credit away from your own opposite financial, these funds also have a constant revenue stream, which is especially important for those on the a fixed money.

Pro: Getting rid of mortgage payments

When taking out an opposing mortgage, the lender pays you and your give it up and also make mortgage payments. So it too are an option work with and something which can be ideal for those people who have a restricted money as they get older. Or for those who would like to possess more income offered to visit, purchase its kids’ knowledge expenditures and other need while they happen.

No responses yet