Household Collateral Loans

Do you have intends to tackle a major renovation? Their Southern State residence’s equity is the the answer to financing. In reality, the new guarantee of your property was a very worthwhile asset. Having a house guarantee mortgage , it equity are often used to funds a lot of things, and home improvements, the baby’s education, unforeseen expenditures, and paying down highest- appeal expenses.

Property equity mortgage can be described as a kind of unsecured debt. It is possible to call-it a collateral mortgage otherwise property equity installment financing . House guarantee fund make it home owners to borrow on this new equity inside the their home. The degree of the borrowed funds is determined by brand new homeowner’s newest mortgage equilibrium in addition to property value their property.

This article will leave you a complete review of domestic equity fund , the advantages and can cost you. Before you apply to own a house collateral financing , definitely read most of the small print, and you can look at the many can cost you, as well as settlement costs, rates of interest , and you will assessment charges. Then you will be capable pick whether a property security mortgage suits you.

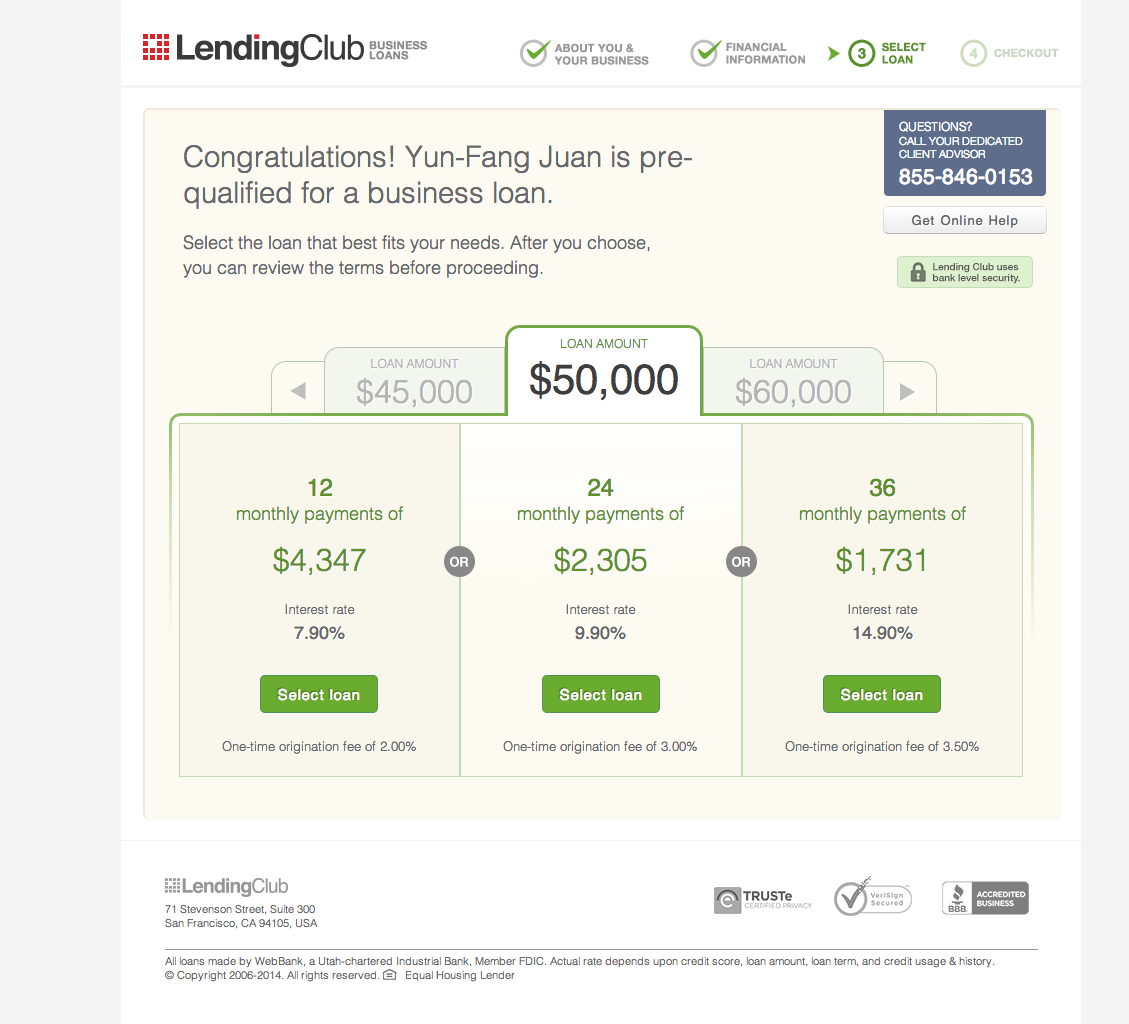

Interest rate

All of our mortgage calculator uses analysis of a number of America’s most respected finance companies and you can thrifts in order to influence the speed to have a home security mortgage . When deciding when the and how much to provide your, loan providers have a tendency to think about the amount of security in your home given that measured by the financing-to-value ratio (or LTV), and that measures up the present day amount you borrowed in your home loan so you can the brand new property’s appraised worth. An 80 % financing-to-worth ratio can be used to assess a $30,000 loan . You truly need to have sufficient equity of your house so you can be eligible for a home equity loan .

Your earnings and you can credit score also are tips during the determining the original rate of interest towards the domestic security loans . A property security loan’s mediocre apr try four percent. Rates are different according to for which you live and you will whom this new bank was. Your location can impact the pace regarding a property equity loan . Boston residents feel the reduced house equity financing rates of interest , when you’re men and women living in the brand new D.C. urban urban area feel the high. The common home guarantee mortgage interest levels throughout the D.C. metropolitan region were 5.20% since pare domestic collateral mortgage rates across towns so you’re able to determine the best.

Southern area State domestic guarantee financing prices was fixed, that’s a great option for those who need the soundness away from make payment on same count per month. Fixed-rate family collateral fund might help all of them stick to budget. Property guarantee credit line , otherwise HELOC, but not, even offers a varying interest rate . Loan providers place the first interest for house collateral personal lines of credit , but industry standards may alter it rate. HELOCs provide so much more flexibility however, run the risk off overspending once the the credit range are leftover unlock. Family equity financing and you can home security credit lines routinely have a high rate of interest than just a primary home loan since they’re 2nd lined up to own cost.

Bank Label

The lending company usually normally provide you a lump sum during the an effective fixed rate of interest for a certain title. Together with picking out the interest to possess a home collateral mortgage affordable, the repayment words should work for you.

The expression duration of family security funds ranges off 5 so you’re able to thirty years. The mortgage name are going to be longer or less according to the borrower’s means and needs. To extend brand new repayment term, extra costs are going to be added and/or mortgage are refinanced. The pace try calculated having fun with products. These types of factors is actually put in the complete desire along the financing name. The pace together with fee title is impacted by the number of fees or facts.

Your debt-to-money proportion is an additional component that you may dictate the decision to help you score a home guarantee loan. The debt-to-earnings ratio (DTI) ‘s the ratio of one’s income comparable to their monthly bills. A lower life expectancy debt-to-income ratio will give you an increased threat of choosing a good financing with a lengthier payment identity. A lowered DTI will even trigger a lesser interest.

When you yourself have sufficient equity of your property, you’re able to use it to finance a variety regarding requires. Should you want to pay off loans, a house equity mortgage can get will let you combine multiple costs and gain economic defense. Domestic collateral money also may help you save money and you will boost your debts. That have all the way down rates of interest than credit cards otherwise signature loans, home guarantee finance usually are a less expensive solution to acquire money.

For individuals who need crisis dollars, family collateral finance might be a great solution. A property security mortgage can be the most suitable choice in online personal loans NM the event the you need a giant mortgage to pay for biggest upfront expenses such as the educational costs.

You might fund significant systems eg domestic home improvements having a home equity loan once you know what kind of cash you need, or a property collateral personal line of credit in case your endeavor needs lingering costs. You have access to the fresh new guarantee of your property in place of refinancing, and come up with monthly payments ultimately.

Before you sign the fresh new deal, be sure to are able new monthly premiums. Definitely research your facts and you can feedback the home equity loan information regarding bank other sites. Its value listing that numerous finance companies enjoys tightened credit formula, and you may temporarily frozen household-guarantee activities in the course of that it article’s guide.

No responses yet